How does it work?

How does it work?

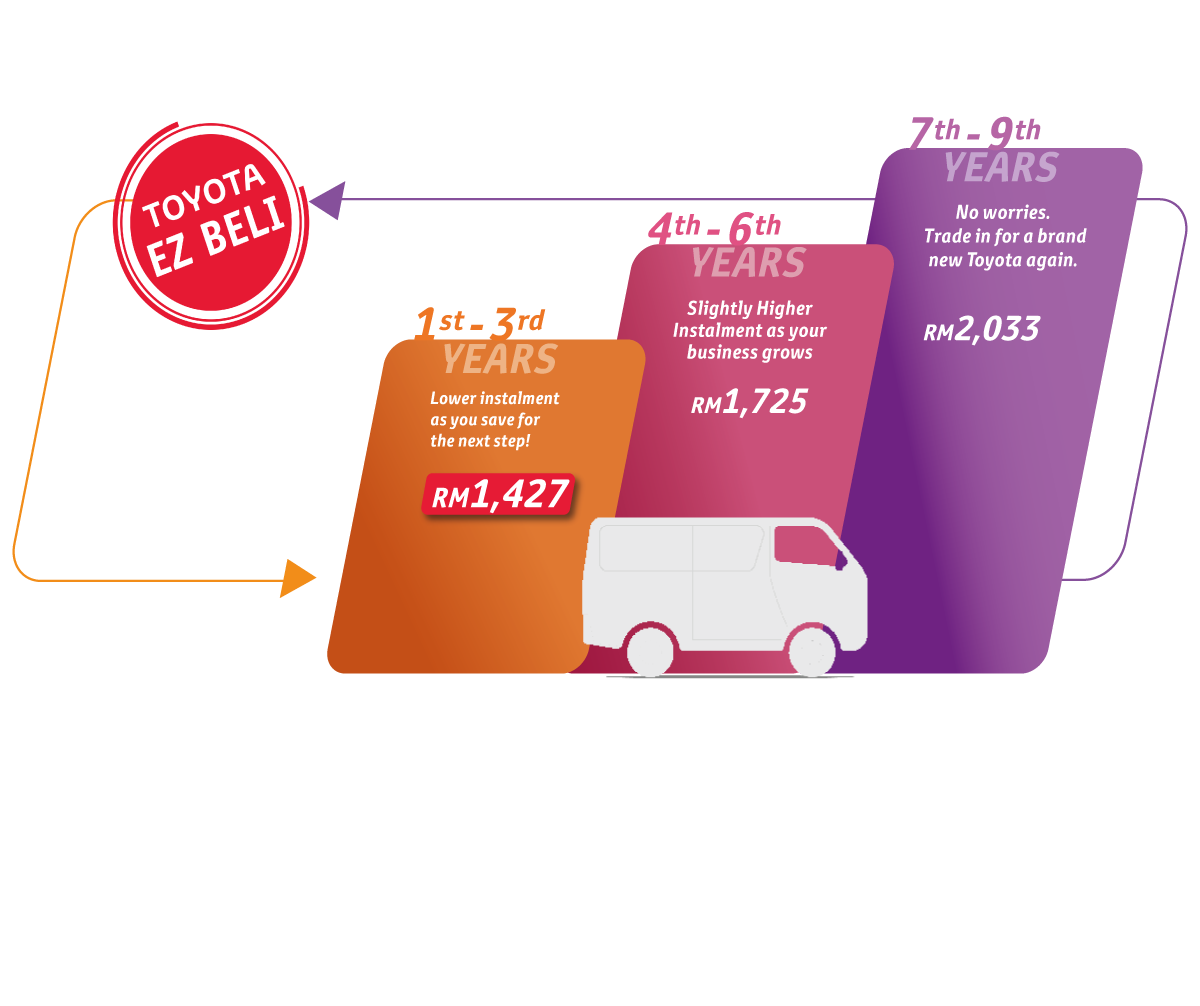

Toyota EZ Beli for Businesses is the latest innovative auto-financing plan from Toyota Capital for commercial vehicles - a hassle-free monthly instalments scheme that differs from the conventional loans. The Toyota EZ Beli for Businesses is a 7-year loan divided into 3 tiers category for the convenience of you, the business owner.

A reliable Toyota for your Business

A reliable Toyota for your Business

This plan is perfect for:

- Startups & micro-businesses

- SMEs

- Small fleet

- Large fleet

Benefits

- Lowest and competitive monthly instalments for the first 3 years

- Slight increase in Tier 2 (Year 4 - 5) in line with your business grow

- Flexible option for Tier 3 (Year 6 - 7): continue repayment OR trade in for a new Toyota

Requirements

Sole Proprietor/Partnership

Proprietor/partner(s) NRIC who sign the HP documents

- Copy of Business Registration (BR)

- Copy of BR Renewal (Form D/E)

- Latest 3 months' bank statement

- Latest Income Tax statement with proof of tax payment

Private/Public Companies (Corporate Applicants)

(Please ensure that the following documents are Certified True Copies)

- Form 9

- Form 49 / Section 58

- Latest 3 months' bank statement OR 1 year Audited Financial Statement

- Board Resolution

- Any one (1) Director's NRIC / Passport

- SSM Statement

Financing Terms

Financing Terms

| Eligibility |

|

| Margin of finance | Maximum 85% financing, minimum loan amount applies. |

| Tenure | 7 years |

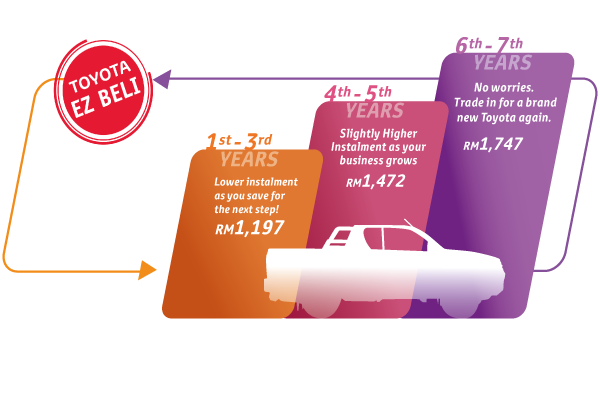

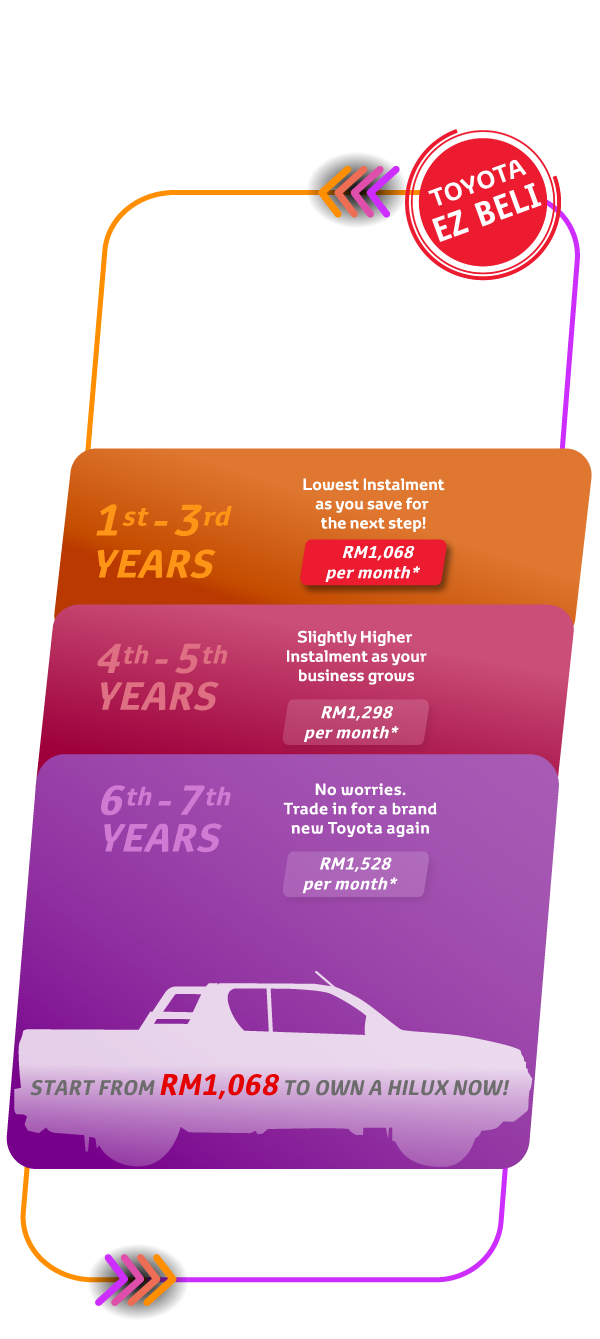

Here's how this unique plan works:

EZ Beli for Businesses FAQs

EZ Beli for Businesses FAQs

-

What is Toyota EZ Beli for Businesses?

This is an easy auto-financing plan especially for vehicles to be used for businesses where you will enjoy lower monthly instalments in the first 3 years of the loan tenure, and your instalments will moderately increase along the tenure. -

What is the difference between this plan and the normal EZ Beli?

The normal EZ Beli plan is a financing plan over a 9-year loan tenure divided into 3 phases of 3 years each; EZ Beli for Businesses is a financing plan over a 7-year tenure divided into 3 years over the first phase, and subsequently 2 years over the 2nd and 3rd phases. -

How long is this loan tenure?

Toyota EZ Beli for Businesses is offered on a 7-year tenure for a new Toyota. Of the 7-year tenure, Tier 1 is 1st to 3rd year, Tier 2 is 4th to 5th year and Tier 3 is 6th to 7th year. -

How much can I borrow?

The maximum loan is 85% of the vehicle's On The Road price. Including Insurance & Road Tax. -

What is the different between this plan compared to other hire purchase plan?

Toyota EZ Beli for Businesses allows you to enjoy lower monthly repayments in the first 3 years of the loan term and subsequently increase moderately as your business grows and cashflows increase. While a conventional Hire Purchase plan requires you to pay the same monthly instalments throughout the loan term. -

I am attracted to your lower monthly payments in Tier 1. Will I be able to afford the higher payments in Tier 2 or Tier 3?

No worries! The repayments in Tier 2 are only slightly higher, with your business growing, you'll be able to service the instalments. At end of Tier 2, you may choose to trade in the car for a new Toyota with Toyota EZ Beli for Businesses again! -

After Tier 2 ended, if I cannot afford the higher repayments in Tier 3, what is my option?

You may opt for early settlement of your car loan. Just trade in your vehicle for a new Toyota, and the trade in value can be used to offset the outstanding balance of your loan. -

Can I pay more in Tier 1 & 2 instalments and what will happen to my loan if I pay more?

Yes, you can pay more in Tier 1 instalments. The additional payment is treated as advance payment. -

Do I get interest rebates from my advance payment?

You'll still get to enjoy the rebate once you settle your loan at end of Tier 2! -

What are the requirements for EZ Beli for Business?

Here are the requirements to register Toyota EZ Beli for Business :

Sole Proprietor/Partnership

Proprietor/partner(s) NRIC who sign the HP documents

- Copy of Business Registration (BR)

- Copy of BR Renewal (Form D/E)

- Latest 3 months' bank statement

- Latest Income Tax statement with proof of tax payment

Private/Public Companies (Corporate Applicants)

(Please ensure that the following documents are Certified True Copies)- Form 9

- Form 49 / Section 58

- Latest 3 months' bank statement OR 1 year Audited Financial Statement

- Board Resolution

- Any one (1) Director's NRIC / Passport

- SSM Statement